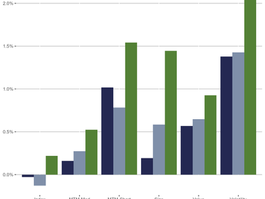

Weekly Factor Returns

Medium-term momentum (MTM) was positive. Stocks that had outperformed the most over the preceding six months continued to outperform last week. Each MTM spread was greater than one standard deviation above average. Short-term momentum (STM) was slightly negative in each index.

Brian

Sep 22, 2025

Weekly Factor Returns

Medium-term momentum (MTM) was influential. The stocks that outperformed the most over the past six months continued to outperform last week. MTM spreads ranged from +2.95% (mid caps) to +4.54% (small caps). All three returns were greater than one standard deviation above their averages.

Brian

Sep 15, 2025

2025 Q2 Small Cap Factor Review

Higher Volatility was a major theme in the second quarter. The small cap Volatility spread was 25.3% in Q2. This was by far the largest spread among the five key factors. The average return of the most volatile ten percent of stocks was 25.3% greater than the average return of the ten percent of stocks with the least Volatility. Volatility is now positive for the year.

Brian

Sep 11, 2025

Weekly Factor Blog

Short-term momentum was the strongest factor in each index with each spread about +2.3%. Stocks that outperformed the most over the previous four weeks continued to outperform last week. The large and small STM spreads were just at one standard deviation above average.

Brian

Sep 8, 2025

Weekly Factor Returns

Factor returns were mostly linear across the capitalization spectrum, with the largest spreads in the small cap universe, followed by mid cap spreads, and the smallest among large caps. Medium-term momentum (MTM) was the lone factor that did not follow that exact pattern. All factor returns were positive and within normal ranges.

Brian

Sep 2, 2025

.png)