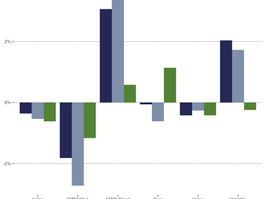

Weekly Factor Returns

Volatility was lower last week as investors sought stocks with lower price Volatility during the market’s decline. Stocks exhibiting the highest Volatility underperformed those with the least Volatility by 2.2% in the large and small indices. Volatility was -2.3% in the mid cap universe.

Brian

Nov 24, 2025

Weekly Factor Returns

Volatility was a driving factor last week. Within the Russell 2000, the most volatile stocks outperformed the least volatile by 5.06%, on average. Volatility spreads were +3.53% and +3.81% in the large and mid cap universes, respectively. All spreads were greater than one standard deviation above their averages.

Brian

Oct 6, 2025

Weekly Factor Returns

Smaller companies were favored last week. The largest companies underperformed the smallest by 2.48%, on average, in the large cap index, where Size has a larger influence on the index relative to the mid and small cap universes. The large cap Size spread was greater than one standard deviation below average.

Brian

Aug 25, 2025

Weekly Factor Returns

Medium-term momentum (MTM) experienced a reversal last week. Stocks that had outperformed the most over the previous six months underperformed last week. MTM was most negative in the Russell 1000 (-2.29%). Short-term momentum (STM) also reversed within the large and mid cap spaces, but was positive in the Russell 2000. The biggest winners in the large and mid cap indices over the previous four weeks tended to underperform last week.

Brian

Aug 18, 2025

Weekly Factor Returns

Size had diverging returns between large and small cap stocks. Within the Russell 1000, the largest ten percent of stocks outperformed the smallest ten percent, on average. The opposite was true in the Russell 2000, where the smallest stocks tended to outperform the largest stocks. The negative small cap Size spread (-4.19%) was just under two standard deviations below its weekly average.

Brian

Aug 11, 2025

Weekly Factor Returns

Medium-term momentum (MTM) was strong across each index. Stocks that outperformed the most over the previous six months continued to outperform last week. MTM was highest in the Russell 2000 (+5.03%). Each MTM spread was greater than one standard deviation above average.

Brian

Aug 11, 2025

Weekly Factor Returns

Stocks that outperformed the most over the previous six months continued to outperform last week, compared to those stocks that underperformed the most over the previous six months. MTM spreads were more than one standard deviation below their averages in each index.

Brian

Jul 28, 2025

Weekly Factor Returns

Value was not favored last week. Stocks with the least attractive valuations outperformed those with the most attractive valuations, on average. The negative Value spread was greatest in the small cap space (-5.67%). The large cap Value spread was -4.18%. Each value spread was greater than two standard deviations below its average.

Brian

Jul 21, 2025

Weekly Factor Returns

Both measures of momentum had sizeable moves last week. Medium-term momentum (MTM) experienced a reversal with negative spreads across each index. Stocks that had outperformed the most over the past six months tended to underperform last week. MTM had the largest decline within the mid cap universe.

Brian

Jul 14, 2025

Weekly Factor Returns

Index gains were driven by a MTM reversal. Stocks that had outperformed the most over the previous six months underperformed last week. The large and mid cap MTM spreads were each greater than one standard deviation below their averages. The small cap MTM spread (-5.83%) was greater than two standard deviations below its average.

Brian

Jul 7, 2025

Weekly Factor Returns

Short-term momentum (STM) was positive in the large and mid cap indices. STM experienced a reversal in the small cap index (-2.86%). The stocks that had outperformed the most during the prior four weeks underperformed last week in the Russell 2000. The negative small cap STM spread was greater than one standard deviation below its average.

Brian

Jun 30, 2025

Weekly Factor Returns

Medium-term momentum (MTM) experienced strong returns within each index. Stocks that had the best performance over the previous six months continued to outperform last week. Each MTM spread was over +2.0%. Short-term momentum (STM) was also positive, but to a lesser degree compared to MTM.

Brian

Jun 23, 2025

Weekly Factor Returns

Volatility was negative, which was a reversal from last week. Stocks with the most price Volatility underperformed the least volatile stocks. The Volatility spread greatest among small caps (-2.18%).

Brian

Jun 16, 2025

Weekly Factor Returns

Volatility was a major driver of returns. The most volatile stocks outperformed the least volatile by 4.69% in the large cap index, 4.53% in the mid cap index, and 7.01% among small caps. The large and mid cap Volatility spreads were greater than one standard deviation and the small cap spread was greater than two standard deviations.

Brian

Jun 9, 2025

Weekly Factor Returns

Factor returns were within expected ranges across the capitalization spectrum. Short-term momentum was the lone factor with directionally similar spreads within each index.

Volatility was positive in the large and mid cap indices. Each spread was close to, or just above, 1.0%. Volatility was slightly negative in the small cap universe.

Value was positive within the mid and small cap indices. The most attractively valued securities underperformed, on average, relative to the l

Brian

Jun 2, 2025

Weekly Factor Returns

MTM experienced the largest spreads in each index. Stocks that had outperformed the most over the previous six months continued to outperform last week. The highest MTM stocks outperformed the lowest MTM stocks by 4.61%, on average, in the large cap universe and by 3.63% among small caps. Both spreads were greater than one standard deviation above average.

Brian

May 27, 2025

Weekly Factor Returns

Value was out of favor last week. Stocks with the most attractive valuations underperformed those with the least attractive valuations. The Value spread was -1.47% in the Russell 1000 and -3.30% in the Russell 2000. The small cap Value spread was greater than one standard deviation below average.

Brian

May 19, 2025

Weekly Factor Returns

Value had the strongest returns in each index. The most attractively valued stocks outperformed the least attractively valued by 2.78% in the Russell 2000 and by 1.99% in the large cap universe. The small cap Value spread was greater than one standard deviation above average.

Brian

May 12, 2025

Weekly Factor Returns

Short-term momentum (STM) experienced a reversal, particularly in the Russell 2000. Stocks that had outperformed the most over the preceding four weeks underperformed last week. The spread between stocks with the highest STM ranks and the lowest was -3.91% in the small cap universe. This was over one standard deviation below average. STM was -1.26% in the large cap universe.

Brian

May 5, 2025

Weekly Factor Returns

High Volatility stocks helped drive the markets higher. The most volatile stocks outperformed the least volatile by 8.19% in the large cap universe and by 5.10% among small caps. The large cap Volatility spread was 2.5 standard deviations above the weekly average. The small cap Volatility exceeded one standard deviation.

Brian

Apr 28, 2025

.png)