Weekly Factor Returns

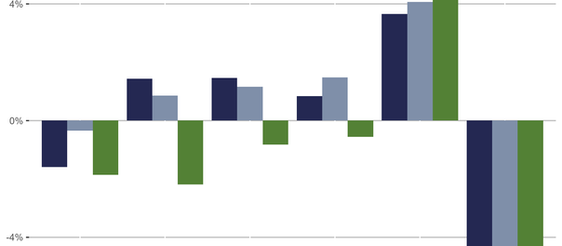

Value was a clear performance driver across all stocks. The most attractively valued securities outperformed the least attractive by 3.65% and 4.07% in the large and mid cap universes, respectively. The large cap spread was greater than one standard deviation above average, while the mid cap spread was two standard deviations above average. In the small cap universe, the Value spread was +7.36%. This equated to a three standard deviation move.

Brian

Nov 10, 2025

Weekly Factor Returns

Medium-term momentum (MTM) was a strong driver of returns, particularly in the large and mid cap universes. Stocks that outperformed the most over the previous six months continued to outperform last week. The large cap MTM spread was +4.46% and the mid cap MTM spread was +4.02%. Both were greater than one standard deviation above their respective average.

Brian

Nov 3, 2025

Weekly Factor Returns

Medium-term momentum (MTM) was strong in the large and mid cap indices. The MTM spread in the Russell MidCap was over 4.0%, while the large cap MTM spread was 3.23%. Both returns were greater than one standard deviation above their average. MTM in the small cap space experienced a small negative return.

Brian

Oct 27, 2025

Weekly Factor Returns

Medium-term momentum (MTM) was the lone factor with similar returns across all three indices in both direction and magnitude. Stocks that had outperformed the most over the past six months continued to outperform last week. MTM spreads were linear across the capitalization spectrum.

Brian

Oct 20, 2025

Weekly Factor Returns

Value was negative. The most attractively valued stocks underperformed the least attractively valued by 3.88% in the small cap universe, by 2.97% in the mid cap universe, and by 2.81% among large caps. Each spread was greater than one standard deviation below its weekly average.

Brian

Oct 13, 2025

Weekly Factor Returns

Volatility was a driving factor last week. Within the Russell 2000, the most volatile stocks outperformed the least volatile by 5.06%, on average. Volatility spreads were +3.53% and +3.81% in the large and mid cap universes, respectively. All spreads were greater than one standard deviation above their averages.

Brian

Oct 6, 2025

Weekly Factor Returns

Both measures of Momentum were negative. Medium-term momentum (MTM) and Short-term momentum (STM) declined the most in the large and mid cap universes. Stocks that had outperformed the most over the past six months and four weeks tended to underperform last week.

Brian

Sep 29, 2025

Weekly Factor Returns

Medium-term momentum (MTM) was positive. Stocks that had outperformed the most over the preceding six months continued to outperform last week. Each MTM spread was greater than one standard deviation above average. Short-term momentum (STM) was slightly negative in each index.

Brian

Sep 22, 2025

Monthly Market Data - August 2025

Most asset classes were positive; Treasury yields moved lower Asset Class Returns Major Asset Class Returns for the Month Ending August...

Brian

Sep 18, 2025

Weekly Factor Returns

Medium-term momentum (MTM) was influential. The stocks that outperformed the most over the past six months continued to outperform last week. MTM spreads ranged from +2.95% (mid caps) to +4.54% (small caps). All three returns were greater than one standard deviation above their averages.

Brian

Sep 15, 2025

.png)