2024 Q2 Factor Review

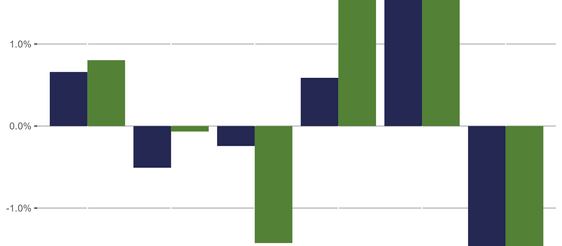

Factors maintain their trajectories Four of our five key factor spreads were directionally similar to the first quarter. Those same four...

.jpg/v1/fill/w_320,h_320/file.jpg)

Brian Harvey

Aug 13, 2024

Weekly Factor Returns

MTM experienced a decile 1 minus decile 10 spread of +8.67%. This was a three standard deviation event. The stocks that had outperformed the

Brian

Aug 12, 2024

Weekly Factor Returns

Factor spreads were large relative to history. Each of the five key factors exceeded one standard deviation in the small cap universe. ...

Brian

Aug 5, 2024

Weekly Factor Returns

The Medium-term Momentum (MTM) reversal continued with -2.40% return in the large cap universe and a -1.87% return among large caps. The ...

Brian

Jul 29, 2024

Quarterly Market Overview

Major asset classes were mixed 2Q-2024 Asset Class Returns Based on Broad ETFs Major Asset Class Returns for the three months ending June...

.jpg/v1/fill/w_320,h_320/file.jpg)

Brian Harvey

Jul 26, 2024

Weekly Factor Returns

Domestic equities were mixed last week. The large cap Russell 1000 declined 1.82% while the small cap Russell 2000 gained 1.69%. Smaller ...

Brian

Jul 22, 2024

Weekly Factor Returns

Size in the large cap universe experienced the most significant move. The largest 10% of stocks in the Russell 1000 underperformed the small

Brian

Jul 15, 2024

Weekly Factor Returns

Size (capitalization) was an influential factor last week. The largest companies outperformed the smallest in the large cap universe by ...

Brian

Jul 8, 2024

Weekly Factor Returns

Momentum factors were negative in the large cap universe. Both Medium-term (MTM) and Short-term-term (STM) experienced declines. Momentum...

Brian

Jul 1, 2024

Weekly Factor Returns

The spread between the most attractively valued stocks and the least attractively valued stocks was +2.70% in the Russell 2000 and +1.71% in

Brian

Jun 24, 2024

.png)