Weekly Factor Returns

- Brian

- May 15, 2023

- 1 min read

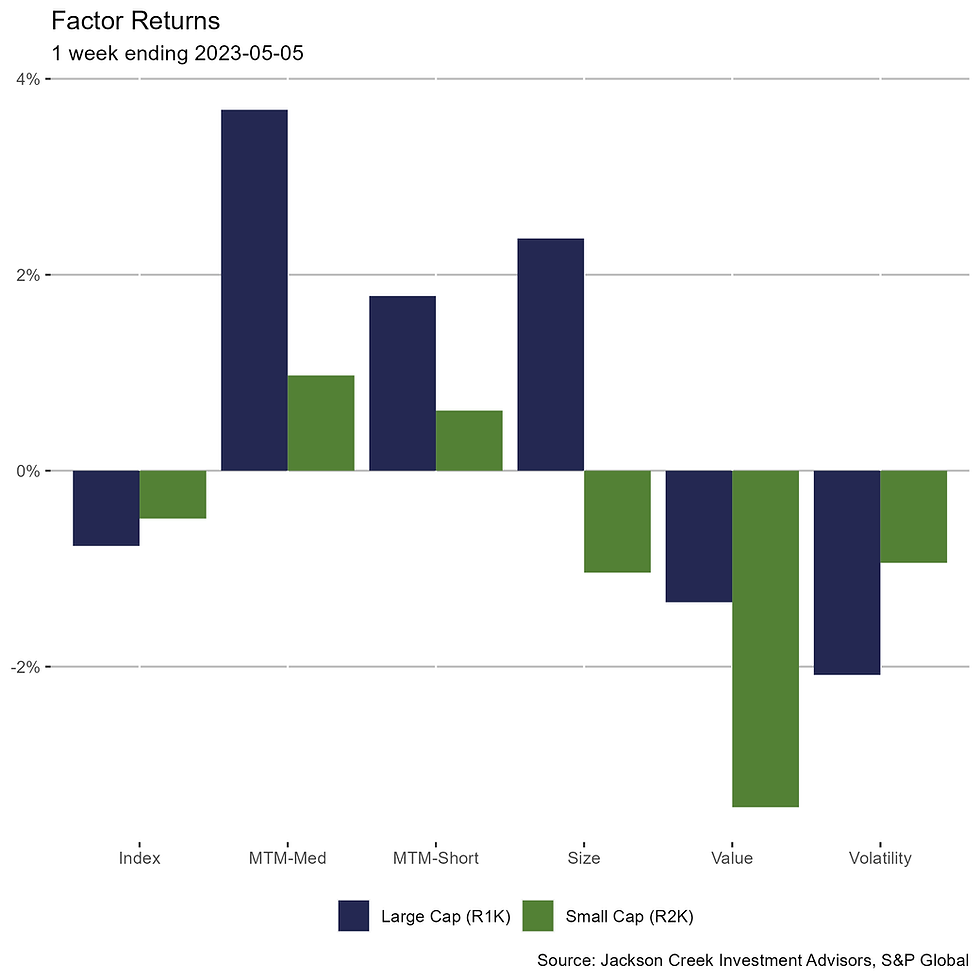

A look at what factors influenced the market last week

The Russell 1000 declined 0.23% and the Russell 2000 declined 1.04%. Four of our factor returns were mixed in terms of direction and/or magnitude.

Positive Medium-term Momentum (MTM) persisted in each capitalization range. The MTM spread in the small cap universe was more pronounced (+1.57%) relative to large caps.

The opposite was true for Short-term Momentum (STM). In the large cap space, the STM spread was 1.33% compared to a slightly negative return among small caps.

Stocks with higher Volatility outperformed those with low Volatility in the small cap universe. Volatility was less influential among large caps.

Value was mixed between the capitalization ranges and Size was positive for both large and small caps.

In this series, we highlight several factors’ returns along with the broad index. These are factors – or stock characteristics – we monitor closely. Factor returns equal the difference in the average return of the highest ranked 10% (decile 1) of stocks minus the lowest ranked 10% (decile 10) within each metric. Returns are based on stocks that pass our screen for liquidity, price, and analyst coverage; therefore, some index constitutes are excluded (except for index return). Ranks are sector neutral and equal weight. Stocks are ranked one week before the return period date, with returns calculated for the following week.

Read factor explanations here.

.png)

Comments